Pricing standing corn for silage can be challenging. There are no widely quoted market prices for this particular crop and values are often based on relative feed value or comparison to other crops, such as corn grain or hay.

Pricing of corn for the seller should take into account the value of grain, the fertilizer cost incurred and harvest costs saved. Corn silage in the field can be valued at eight to 10 times the price of corn per grain bushel.

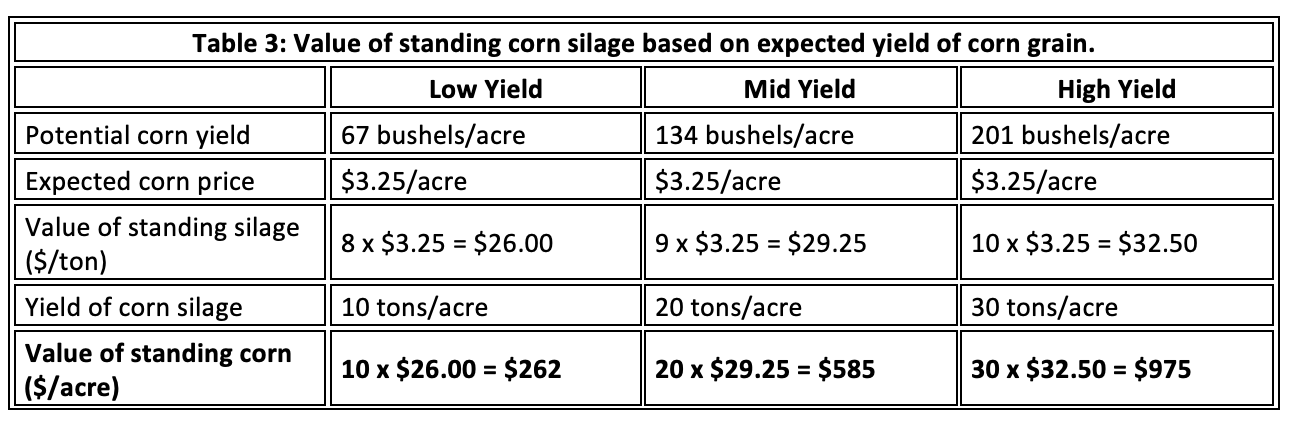

Table 3 provides an estimate of the potential value of corn silage based on corn grain yields. If the potential yield is lower, a factor of 8 is recommended whereas a higher factor, such as 10, is often used for higher yield corn grain.

What about different moisture?

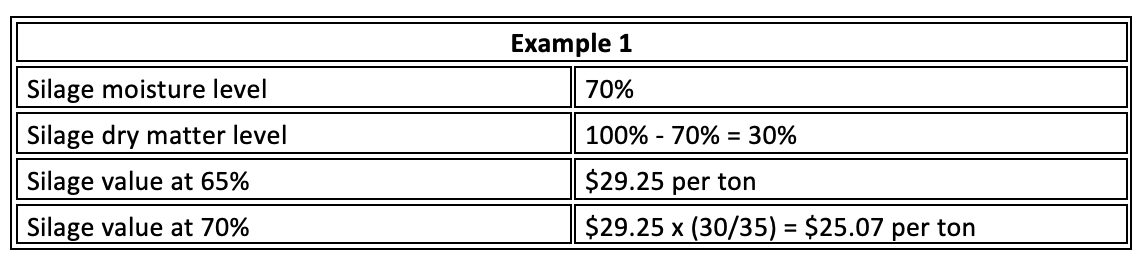

The calculations used in Table 3 assume corn silage is at 65% moisture. To accurately adjust for moisture levels, subtract the actual moisture level from 100. Then divide by 35 followed by multiplying the estimated value for 65% moisture. For example:

As a rule of thumb in Michigan, each bushel of 15% moisture can be equivalent to .150 tons of 65% moisture corn silage. So, a field with an expected yield of 170 bushels per acre could be expected to produce (134 x .150) = 20 tons of silage. Nearby fields can be used to estimate grain yield or check strips can be left in the harvested field.

As a rule of thumb in Michigan, each bushel of 15% moisture can be equivalent to .150 tons of 65% moisture corn silage. So, a field with an expected yield of 170 bushels per acre could be expected to produce (134 x .150) = 20 tons of silage. Nearby fields can be used to estimate grain yield or check strips can be left in the harvested field.

Factoring in the corn stover

One of the key differences between harvesting corn for silage versus grain is that the entire plant is taken when harvesting silage. This means that plant material and nutrients that would have eventually been available to future crops have now been removed.

Keep in mind the overall health of the corn as normal yielding corn will have dry matter equal to that of grain. Whereas lower yielding corn will have less dry matter (usually 25% to 40%instead of the usual 35%).

Feed value to the buyer

They buyer should estimate the value of corn silage based on the value of the feed it will replace. This will be the buyer’s maximum bid price.

For example, if the grain yield would have been 134 bushels per acre and the price of corn is $3.25 per bushel, the grain component of the silage is worth: 134 bu. / acre x $3.25 / bu. = $435.50/acre. This accounts for 50% of the total value.

The other 50% of the silage dry matter can be assumed to be stover. The value of stover can be calculated as follows, if the current price of grass hay is $100/ton:

- 20 tons of silage x 50% forage = 10 tons stover

- 10 tons x (35% silage dry matter / 90% hay dry matter) = 3.89 tons of hay equivalent at $100/ton = $389

The combined feed value of the silage is $435.50 (grain) + $389 (stover) = $824.50/acre, or $41.23/ton of silage for a yield of 20 tons per acre.

If the buyer must also harvest the silage, the feed value should be reduced by the cost of harvesting. Keep in mind that for the buyer, harvest costs for silage would be different than harvest costs for grain.

For example, if the custom rate for chopping, hauling and storing silage is $10/ton, the value of the standing silage to the buyer is reduced to $41.23 – $10 = $31.23 per ton, or $624.60 per acre. If the standing corn is a significant distance away, additional costs should be considered in the harvest cost portion of the calculation.

Opportunity cost to the seller

It’s important to remember that the seller gives up several opportunities if the field is sold for silage versus grain. There is the opportunity to sell the grain, valued in the previous example at $435.50/acre. The seller may have also intended other uses for the field, including the stover.

These may have included selling the stover for feed or bedding and event renting the field for crop residue grazing. These lost revenues should be considered in the seller’s price.

If the corn is sold for silage, the entire corn plant (grain and stover) will be removed at the time of harvest. This may require additional fertilizer costs to the seller to replace the lost nutrients.

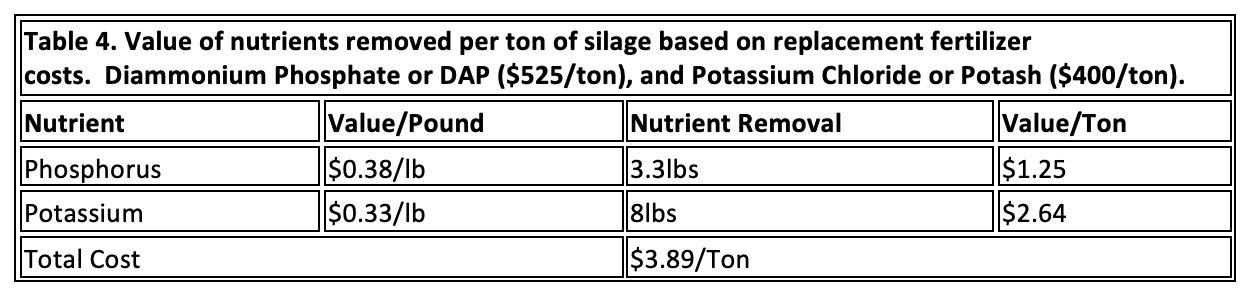

The MSU Nutrient Recommendation for Field Crops Bulletin E-2904 outlines that corn silage contains 9.4 lbs of Nitrogen, 3.3 lbs of Phosphorus (P205) and 8 lbs of Potassium (K20). Table 4 outlines valuing the nutrients removed per ton of silage using the cost of commercial fertilizers.

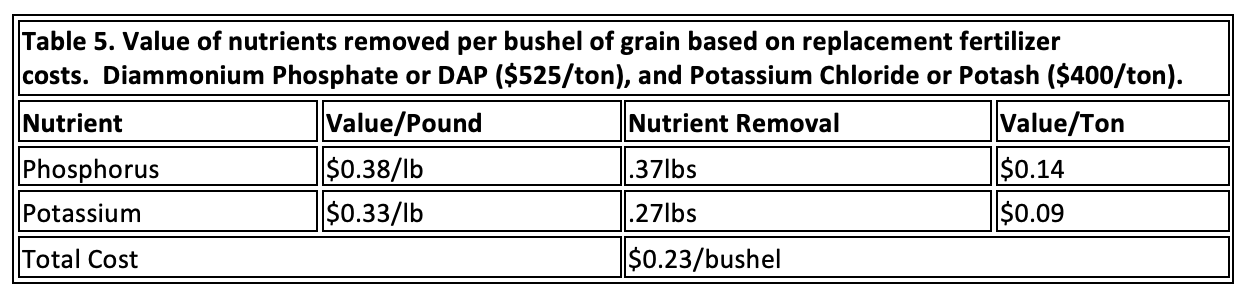

Using the example in Table 3 of 20 tons for the yield, the per acre charge would be 20 tons x $3.99/ton = $79.80/acre. To gain an accurate value for fertilizer replacement, the nutrient removal from grain should then be removed from the $77.88/acre. Table five outlines valuing the nutrients removed per bushel of grain using commercial fertilizers costs.

Using the example in Table 3 of 20 tons for the yield, the per acre charge would be 20 tons x $3.99/ton = $79.80/acre. To gain an accurate value for fertilizer replacement, the nutrient removal from grain should then be removed from the $77.88/acre. Table five outlines valuing the nutrients removed per bushel of grain using commercial fertilizers costs.

Calculate the grain removal by multiplying $0.23/bushel by the 134 bushels (reference Table 3) to find the grain removal value of $30.82/acre. The total fertilizer cost to the seller would then be $77.88 – $30.82 = $47.06 per acre or $2.35 per ton.

Calculate the grain removal by multiplying $0.23/bushel by the 134 bushels (reference Table 3) to find the grain removal value of $30.82/acre. The total fertilizer cost to the seller would then be $77.88 – $30.82 = $47.06 per acre or $2.35 per ton.

If the nutrient removal will be used in price determinations, it is important to define in the agreement what fertilizer prices will be used in the calculation. Ensure that the calculation listed in the agreement will also reflect harvested yields.

READ NEXT: LOWERED EXPECTATIONS — BUT STILL ROOM FOR OPTIMISM IN MI CROP FORECAST

Another consideration is that the seller will save on the cost of harvesting, storing, and drying the grain. Typical custom rates can be used to estimate these costs. For example: combining ($35 per acre) + hauling and storing grain ($0.05 x 134 bushels) + drying costs ($.20 x 134 bushels) = $68.50 per acre.

The net cost to the seller would then be the gross revenue of the grain ($585/acre) plus the lost nutrient removal ($47.06/acre) minus the harvest savings ($68.50/acre). Using our example, this would result in a value of $563.56/acre or $28.18/ton from this 20-ton yield.

This would be is the minimum bid the seller can afford to accept.

Risk

Lower-than-expected yields or weather delays lowering quality can greatly reduce the net gain of purchasing standing forages. Producers need to adjust numbers in these examples to reflect current market conditions, yield and harvest timeliness. The value of risk is difficult to estimate but can be based on a typical value of the desired forage quality.

Contracts signed well before harvest and full season should reflect a lower price due to the greater risk the buyer is assuming. In contrast, an agreement made close to harvest would be much closer to the current forage price because the buyer knows the status of the crop being purchased.

Negotiation needs consistency whether the setting of marketable yield and average price already reflect the vulnerabilities of producing forages or whether an additional adjustment is needed.

Fine-tuning price

The buyers of standing forages are often livestock producers who may be willing to spread manure on fields where the forages are harvested. The economic value of manure as a replacement fertilizer should be taken into consideration. Often, the purchaser’s price is adjusted for the reduction in the seller’s fertilizer expenses (i.e., based on nutrient removal).

Opportunities may also exist for the buyer to custom harvest the seller’s other crops, providing convenience and value to their operation. The value should be considered in determining a price of standing forage, particularly for farms with smaller equipment or absentee landlords.

Final consideration

A written agreement prior to start of harvest is recommended and should include price, when payment is due, method of determining yield when selling by the ton, and other pertinent factors. A written contract clarifies the sale agreement for all parties and provides a record to eliminate differing memories of what was agreed to.